November Sustainable Strategy Listing It is important that the green money is invested into companies and projects that can bring a maximum impact, emission reduction, and take into consideration material and energy efficiencies. The strategies of fossil companies are crucial and different and should be used as a guideline for funding and investors. Therefore, the below listing is a guideline to support investors on finding companies with high potential impact and also to guide companies in future-proofing their strategy. In general, companies can be given 'school grades' ranging from A to F depending on their climate impact: A) Netpositive, reuse, circular solution, recycling and bio-based/renewable/CO2 based material companies. Reason for company existence is to decouple fossil emissions and linear economy. e.g. Reuse models, 2nd hand retail, mechanical and chemical recycling, waste management & sorting, recyclable bioplastics Existing fossil companies B) Develop larg...

Tekstit

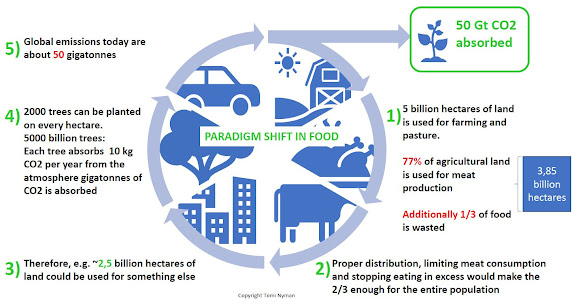

Paradigm shift in Food

- Hae linkki

- X

- Sähköposti

- Muut sovellukset

All rights reserved by Tomi Nyman Changing what we eat and how we treat our food can solve climate change and biodiversity crisis. The world is struggling to find solutions to mitigate climate change and reduce emissions at a rate which would be sufficiently fast enough to slow down global warming. Global warming is leading to a wide range of adverse climate issues and environmental hazards which such as the fires in Australia soon reach scales which are unbearable and challenging if not impossible to control. Biodiversity crisis is an even bigger challenge that requires further attention. The global population is expected to grow by 2 billion in the next decades before 2050 and by then, also the number of people enjoying middle-class level income is expected to grow from approx. 3,5 to 5,5 billion out of the by then 9,5 billion people. Today, in 2020, approximately 1/3 of the food leaving the fields, is lost due to poor logistics, planning and gross negligence. Alrea...

The End of Linear Economy

- Hae linkki

- X

- Sähköposti

- Muut sovellukset

Copyright and all rights reserved Tomi Nyman I have often considered about the current linear economy and demand for continuous growth. We have recently been hit with a strong fear for a long and deep recession. Last summer I started to think about an option: What if central banks induced a 'recession' on purpose by gradually but firmly increasing interest rates until people and enterprises are driven to favor a circular economy to save in virgin raw material costs? 'Change' is a word that makes people worried as it often implies changing routines - and this is exactly what should be done with linear economy. The definition of recession relates to the linear growth, but what if we stop fighting to try and preserve it by keeping interest rates low - a very topical question again today. Central banks intend to keep linear economy growing in danger of a recession and interest rates remain low. If everyone knew that the interest rates will grow by e.g. 0,1% ...